Insights, Strategies, and Stories for Founders and Innovators.

The Exit Playbook: 6 Battle-Tested Rules For Building Startups

Every founder wants an exit, but only a few make it happen.

Our analysis of four $100M+ exits shows a surprising pattern: the founders who succeeded broke the rules—entering competitive markets, killing profitable products, and outsmarting bigger players.

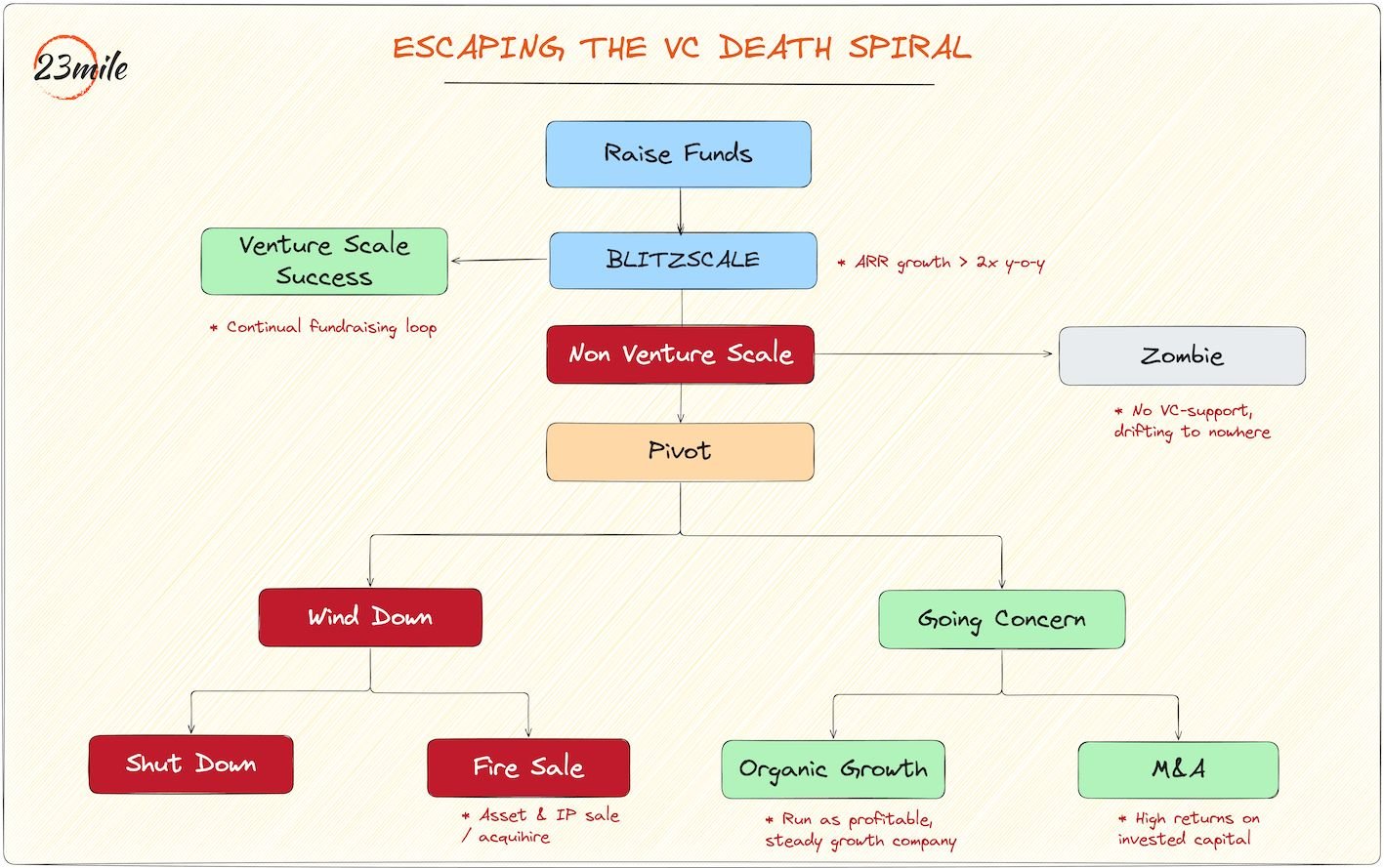

Built to Die: The Venture Capital Zombie Trap

Many venture-backed startups are, by design, Built to Die. The relentless pressure to chase hypergrowth over profitability creates 'zombie' companies and forces even successful founders into a death spiral, constantly chasing the next funding round. But there is an escape route. This post breaks down why the VC path is often a trap and provides a founder's playbook for making the difficult but necessary pivot to a sustainable, profitable business that lasts.