Insights, Strategies, and Stories for Founders and Innovators.

The Truth About Fundraising: From Founders Who’ve Gone The Distance

Some rejected Shark Tank. Some rejected Techstars. One turned down $100M and his company failed. But he'd make the same decision again.

10 founders share the unfiltered truth about fundraising: when to raise, when to bootstrap, and when saying NO is the power move.

The Exit Playbook: 6 Battle-Tested Rules For Building Startups

Every founder wants an exit, but only a few make it happen.

Our analysis of four $100M+ exits shows a surprising pattern: the founders who succeeded broke the rules—entering competitive markets, killing profitable products, and outsmarting bigger players.

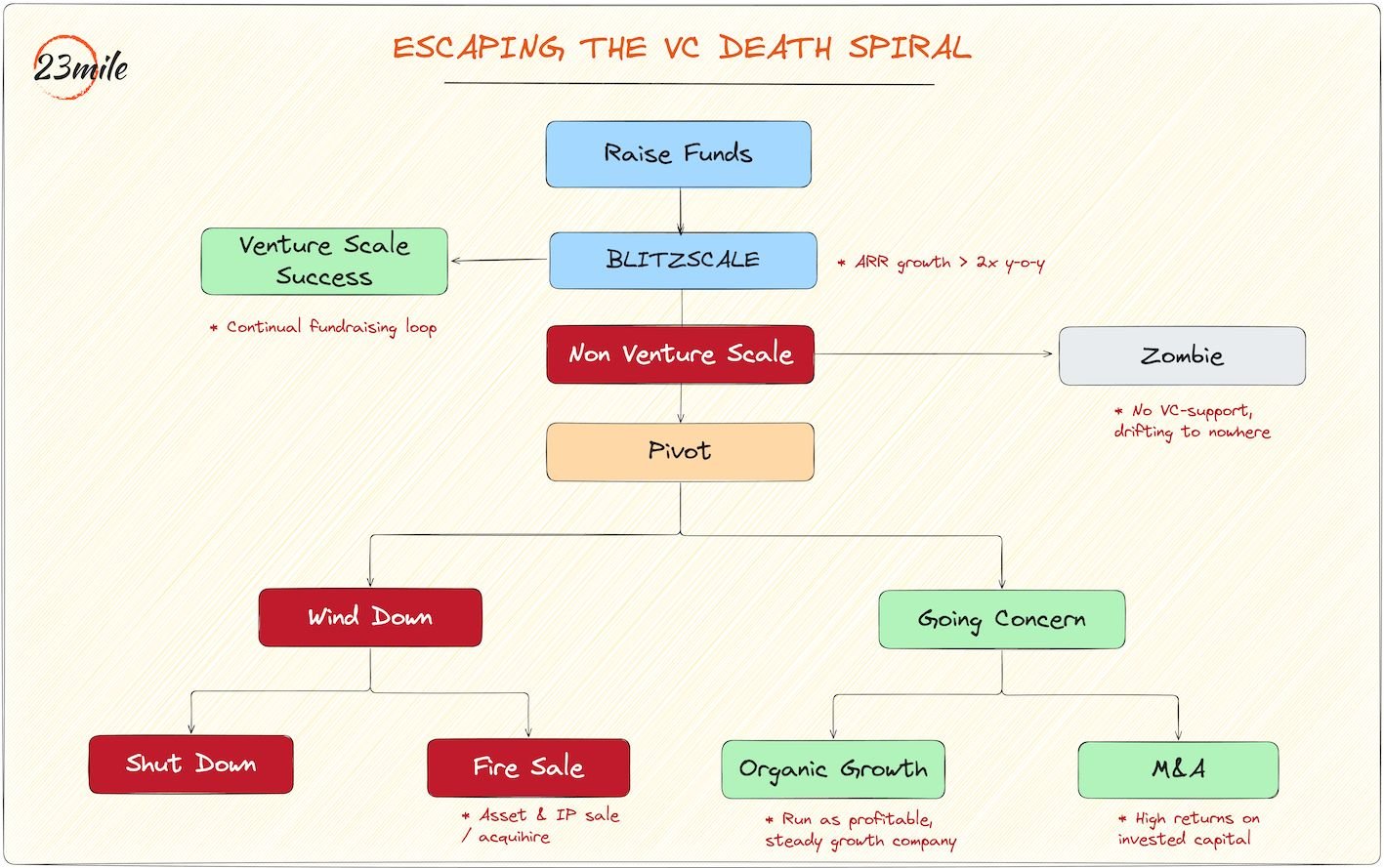

Built to Die: The Venture Capital Zombie Trap

Many venture-backed startups are, by design, Built to Die. The relentless pressure to chase hypergrowth over profitability creates 'zombie' companies and forces even successful founders into a death spiral, constantly chasing the next funding round. But there is an escape route. This post breaks down why the VC path is often a trap and provides a founder's playbook for making the difficult but necessary pivot to a sustainable, profitable business that lasts.

OPUS Peer-led: M&A Readiness for Startups

M&A success isn’t about being “big enough”—it’s about being ready. OPUS Peer-led helps founders learn what buyers look for, avoid deal-breaking mistakes, and position their startups for meaningful exits—all through practical, founder-to-founder insights.

Ditching the Moonshots: Mapping the Anti‑Power Law Venture Landscape

Most VCs see hunting unicorns as the only way to achieve their target returns.

But some are bucking the power law approach. We map the Anti‑Power Law venture landscape, highlighting funds that focus on moderate returns, rollup plays, and distressed turnarounds

Stalled to Sold: Unlocking Liquidity in Under-Performing VC Portfolios

Venture capital is facing an existential crisis. Trillions of dollars are stuck in portfolio companies which are not able to exit many years after raising initial funds. VCs are therefore unable to recycle capital back to LPs, impacting ability to raise new funds. We explore how VCs can unlock liquidity across their portfolio. From the high fliers and the struggling companies